Successful people share advice they wish they had known in their 20s

Money comes to you when you are ready for it

- List View

- Player View

- Grid View

Advertisement

-

1.

Farnoosh Torabi, personal-finance expert, best-selling author, host of the daily podcast, “So Money” “I would insist upon my younger self to be more thoughtful about credit. I opened up random credit cards in college just to win the silly shot glasses and tee-shirts. I opened multiple store cards to get the 20% discounts, all without really understanding the importance of paying bills off in full every month. As a result, my credit score suffered and I even got denied additional credit at one point due to a late payment incident.”

Farnoosh Torabi, personal-finance expert, best-selling author, host of the daily podcast, “So Money” “I would insist upon my younger self to be more thoughtful about credit. I opened up random credit cards in college just to win the silly shot glasses and tee-shirts. I opened multiple store cards to get the 20% discounts, all without really understanding the importance of paying bills off in full every month. As a result, my credit score suffered and I even got denied additional credit at one point due to a late payment incident.” -

2.

![Mark Cuban, billionaire entrepreneur, investor

“[I wish I knew] that credit cards are the worst investment that you can make. That the money I save on interest by not having debt is better than any return I could possibly get by investing that money in the stock market. I thought I would be a stock-market genius. Until I wasn’t.

“I should have paid off my cards every 30 days.”](https://cdn.ebaumsworld.com/mediaFiles/picture/2424434/85159238.jpg) Mark Cuban, billionaire entrepreneur, investor “[I wish I knew] that credit cards are the worst investment that you can make. That the money I save on interest by not having debt is better than any return I could possibly get by investing that money in the stock market. I thought I would be a stock-market genius. Until I wasn’t. “I should have paid off my cards every 30 days.”

Mark Cuban, billionaire entrepreneur, investor “[I wish I knew] that credit cards are the worst investment that you can make. That the money I save on interest by not having debt is better than any return I could possibly get by investing that money in the stock market. I thought I would be a stock-market genius. Until I wasn’t. “I should have paid off my cards every 30 days.” -

3.

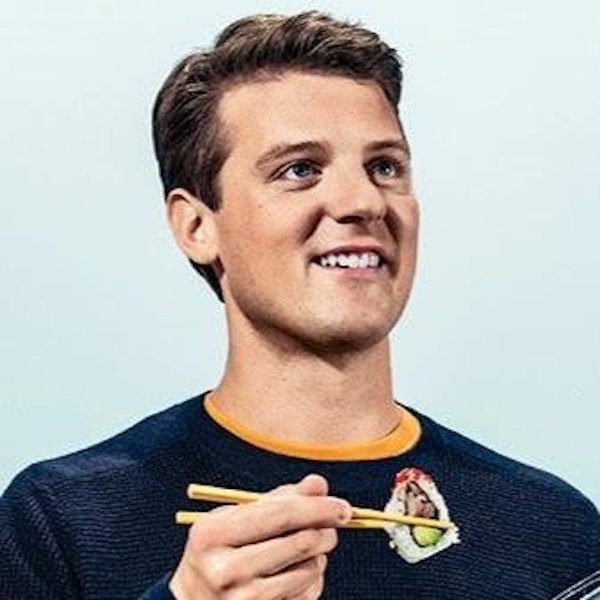

Lewis Howes, lifestyle entrepreneur, business coach, author of “The School of Greatness” “Money comes to you when you are ready for it. Start creating auto payments to your savings and investments early on, even if it’s $10 a month — and then, each year increase the auto payments to something that feels uncomfortable, and stick with it.”

Lewis Howes, lifestyle entrepreneur, business coach, author of “The School of Greatness” “Money comes to you when you are ready for it. Start creating auto payments to your savings and investments early on, even if it’s $10 a month — and then, each year increase the auto payments to something that feels uncomfortable, and stick with it.” -

4.

Blake Mycoskie, founder, chief shoe giver of TOMS “In my 20s I wish I knew that the best advice for any person is to follow their passion as opposed to chasing money. I’ve seen time and time again that the people who foster their true passions and true callings are the ones that end up the most successful. It’s hard in your 20s not to worry about money, but to focus on making sure you do something you love. Today, I feel like every time I’ve made a decision at TOMS that I’m passionate about and improves someone’s life, the company grows and makes more money.”

Blake Mycoskie, founder, chief shoe giver of TOMS “In my 20s I wish I knew that the best advice for any person is to follow their passion as opposed to chasing money. I’ve seen time and time again that the people who foster their true passions and true callings are the ones that end up the most successful. It’s hard in your 20s not to worry about money, but to focus on making sure you do something you love. Today, I feel like every time I’ve made a decision at TOMS that I’m passionate about and improves someone’s life, the company grows and makes more money.” -

5.

Adam Nash, president and CEO of Wealthfront “I was fortunate to have been raised with a strong sense of the importance of saving and living below your means. However, it wasn’t until later that I learned just how much of your long-term economic success depends on your professional career.”

Adam Nash, president and CEO of Wealthfront “I was fortunate to have been raised with a strong sense of the importance of saving and living below your means. However, it wasn’t until later that I learned just how much of your long-term economic success depends on your professional career.” -

6.

Elliot Weissbluth, CEO of HighTower “Don’t go into debt unless it’s to make a long-term investment that will pay off in the future, like a home that will increase in value over time or an education that increases your earning power. Fortunately, I figured this one out as a college student shopping for a new car. The temptation to take out a loan and buy a shiny new model was there, but once I did the math and saw the true cost of the payments and interest, I couldn’t justify borrowing so much money to buy a vehicle that would start to decline in value the moment I drove it off the lot.

Elliot Weissbluth, CEO of HighTower “Don’t go into debt unless it’s to make a long-term investment that will pay off in the future, like a home that will increase in value over time or an education that increases your earning power. Fortunately, I figured this one out as a college student shopping for a new car. The temptation to take out a loan and buy a shiny new model was there, but once I did the math and saw the true cost of the payments and interest, I couldn’t justify borrowing so much money to buy a vehicle that would start to decline in value the moment I drove it off the lot. -

7.

Matt Maloney, CEO of GrubHub “Money does not define success or happiness. In fact, if you are truly effective at what you enjoy, money usually follows your passion. Passion drives interest, which in turn drives focus and commitment. Both qualities are requirements for success.”

Matt Maloney, CEO of GrubHub “Money does not define success or happiness. In fact, if you are truly effective at what you enjoy, money usually follows your passion. Passion drives interest, which in turn drives focus and commitment. Both qualities are requirements for success.” -

8.

Kevin Cleary, CEO of Clif Bar & Company “In my 20s, I wish I better understood the power of investing. At the time, I had fewer expenses, more free time, and a long investment horizon — it would have been the perfect time to learn about investing. While I was disciplined about saving money, I missed the opportunity to leverage my money over the long haul.”

Kevin Cleary, CEO of Clif Bar & Company “In my 20s, I wish I better understood the power of investing. At the time, I had fewer expenses, more free time, and a long investment horizon — it would have been the perfect time to learn about investing. While I was disciplined about saving money, I missed the opportunity to leverage my money over the long haul.” -

9.

Kate White, former editor-in-chief of Cosmopolitan, author of “I Shouldn’t Be Telling You This” “I was a great saver in my 20s — my dad had persuaded me to save for retirement, which seemed insane at the time, but I’m eternally grateful. But what I didn’t know and wish I had is that it’s so much smarter to buy a few great quality items — in terms of clothes, furniture, accessories — rather than a bunch of cheaper stuff.”

Kate White, former editor-in-chief of Cosmopolitan, author of “I Shouldn’t Be Telling You This” “I was a great saver in my 20s — my dad had persuaded me to save for retirement, which seemed insane at the time, but I’m eternally grateful. But what I didn’t know and wish I had is that it’s so much smarter to buy a few great quality items — in terms of clothes, furniture, accessories — rather than a bunch of cheaper stuff.” -

10.

Sophia Amoruso, founder of Nasty Gal, author of “#GIRLBOSS,” writes in her book “My adopted political ideals had let me approach money with an elevated level of distaste. I saw it as a materialistic pursuit for materialistic people, but what I have realized over time is that in many ways, money spells freedom. If you learn to control your finances, you won’t find yourself stuck in jobs, places, or relationships that you hate just because you can’t afford to go elsewhere. Learning how to manage your money is one of the most important things you’ll ever do.

Sophia Amoruso, founder of Nasty Gal, author of “#GIRLBOSS,” writes in her book “My adopted political ideals had let me approach money with an elevated level of distaste. I saw it as a materialistic pursuit for materialistic people, but what I have realized over time is that in many ways, money spells freedom. If you learn to control your finances, you won’t find yourself stuck in jobs, places, or relationships that you hate just because you can’t afford to go elsewhere. Learning how to manage your money is one of the most important things you’ll ever do. -

11.

Debbi Fields, founder of Mrs. Fields “Looking back now, I know that I would have greatly benefited had I initiated an investment strategy as a young adult. I was so busy trying to save every dollar and living paycheck to paycheck that the idea of wealth creation was never really a consideration. Not thinking bigger than my bank account was my error — I could have set up a simulated investment account, joined a club, or learned about the buying and selling of securities.

Debbi Fields, founder of Mrs. Fields “Looking back now, I know that I would have greatly benefited had I initiated an investment strategy as a young adult. I was so busy trying to save every dollar and living paycheck to paycheck that the idea of wealth creation was never really a consideration. Not thinking bigger than my bank account was my error — I could have set up a simulated investment account, joined a club, or learned about the buying and selling of securities. -

12.

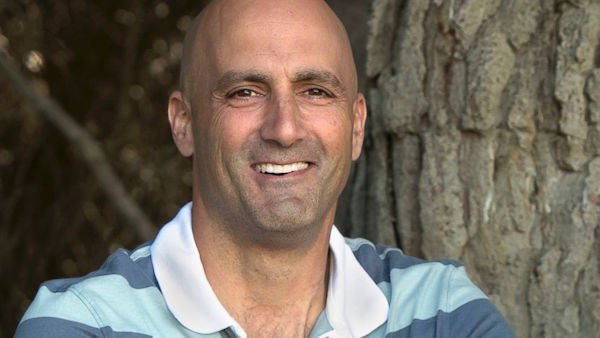

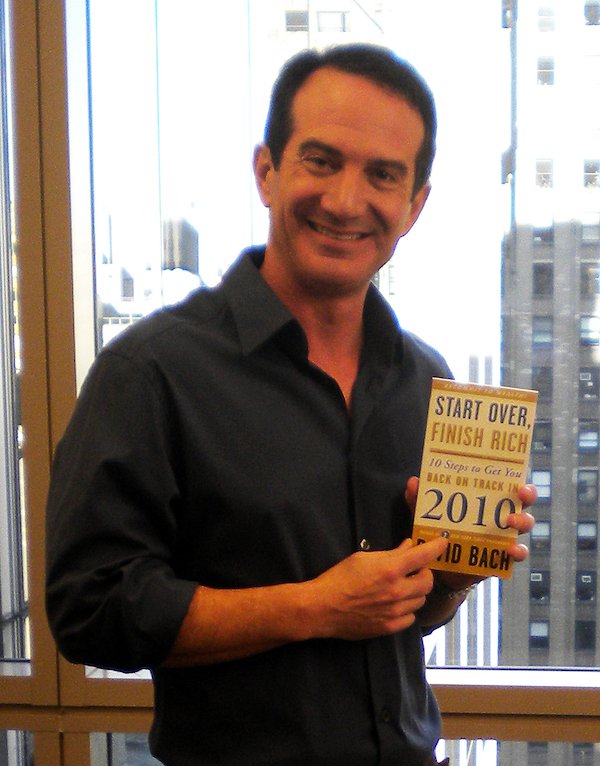

David Bach, best-selling author, founder of FinishRich Media “In business and life I would tell my younger self to ‘bet on yourself to win.’ You’re going to have big dreams against huge odds, with a goal of being of service to millions of people, and many people will laugh and tell you why it can’t be done by you (and they will all be wrong).”

David Bach, best-selling author, founder of FinishRich Media “In business and life I would tell my younger self to ‘bet on yourself to win.’ You’re going to have big dreams against huge odds, with a goal of being of service to millions of people, and many people will laugh and tell you why it can’t be done by you (and they will all be wrong).” -

13.

Neil Blumenthal, cofounder and co-CEO of Warby Parker “Set yourself on a path to financial success. Focus on industries and companies that are growing. There will be more opportunities. … To create future opportunities, identify the skills that are required to do the jobs of your boss and boss’ boss and set out to learn those skills over time.”

Neil Blumenthal, cofounder and co-CEO of Warby Parker “Set yourself on a path to financial success. Focus on industries and companies that are growing. There will be more opportunities. … To create future opportunities, identify the skills that are required to do the jobs of your boss and boss’ boss and set out to learn those skills over time.” -

14.

Tim Ferriss, angel investor, best-selling author of “The 4-Hour Workweek” “In your 20s, optimize for learning, not earning. Work directly under or with master dealmakers and acquire skills. This is particularly true for negotiating and hard skills, like coding. What would you rather have: $20,000 more per year in your 20s, leading to making $100,000 to $200,000 a year in your 30s, or a lower-paying job from 20 to 25 — but one like a real-world MBA you’re paid for — leading to making millions in your 30s?

Tim Ferriss, angel investor, best-selling author of “The 4-Hour Workweek” “In your 20s, optimize for learning, not earning. Work directly under or with master dealmakers and acquire skills. This is particularly true for negotiating and hard skills, like coding. What would you rather have: $20,000 more per year in your 20s, leading to making $100,000 to $200,000 a year in your 30s, or a lower-paying job from 20 to 25 — but one like a real-world MBA you’re paid for — leading to making millions in your 30s? -

15.

Alexa von Tobel, founder and CEO of LearnVest.com, author of “Financially Fearless” “Not having a financial plan is a plan — just a really bad one! Given what I see as a general lack of personal-finance education, it can be all too easy to wing it with your money. I was lucky enough to learn this lesson while still in my 20s, so I had time to put a financial plan into place for myself — and start LearnVest to help people nationwide do the same!”

Alexa von Tobel, founder and CEO of LearnVest.com, author of “Financially Fearless” “Not having a financial plan is a plan — just a really bad one! Given what I see as a general lack of personal-finance education, it can be all too easy to wing it with your money. I was lucky enough to learn this lesson while still in my 20s, so I had time to put a financial plan into place for myself — and start LearnVest to help people nationwide do the same!” -

16.

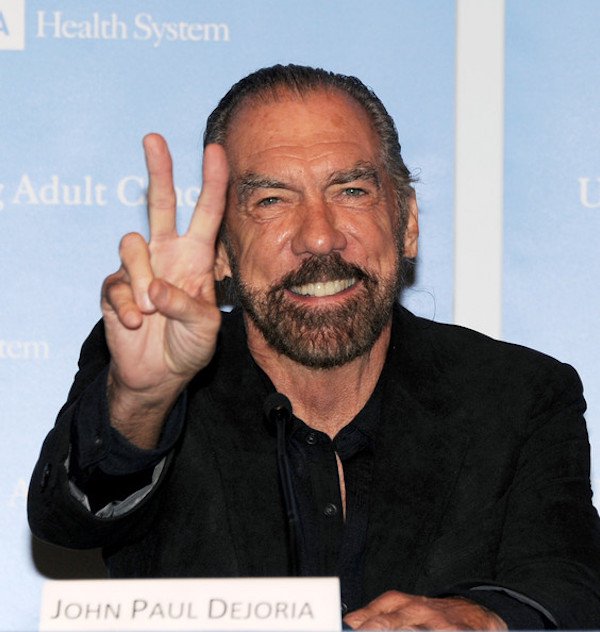

John Paul DeJoria, cofounder of John Paul Mitchell Systems and Patrón tequila “Before investing or starting a company, make sure you have enough money saved for at least six months to pay bills or anything else that might come up financially. It’s important to have a cushion of six months financial back-up before you invest or if something doesn’t work out in your favor.”

John Paul DeJoria, cofounder of John Paul Mitchell Systems and Patrón tequila “Before investing or starting a company, make sure you have enough money saved for at least six months to pay bills or anything else that might come up financially. It’s important to have a cushion of six months financial back-up before you invest or if something doesn’t work out in your favor.” -

17.

Steve Siebold, self-made millionaire, author of “How Rich People Think” “I should have invested more time in my 20s studying equities, even when I didn’t have money to invest. It would have prepared me better when I entered the stock market later on.”

Steve Siebold, self-made millionaire, author of “How Rich People Think” “I should have invested more time in my 20s studying equities, even when I didn’t have money to invest. It would have prepared me better when I entered the stock market later on.”

- REPLAY GALLERY

-

- Successful people share advice they wish they had known in their 20s

Farnoosh Torabi, personal-finance expert, best-selling author, host of the daily podcast, “So Money” “I would insist upon my younger self to be more thoughtful about credit. I opened up random credit cards in college just to win the silly shot glasses and tee-shirts. I opened multiple store cards to get the 20% discounts, all without really understanding the importance of paying bills off in full every month. As a result, my credit score suffered and I even got denied additional credit at one point due to a late payment incident.”

17/17

1/17

Categories:

Ftw

![People Share Companies' 'Dirty Little Secrets' That Made Them Stop Buying <p>If you knew what was really going on behind the scenes, would you keep giving a business your hard-earned money? That's the decision that these people had to make when they discovered a service or <a href="https://www.ebaumsworld.com/pictures/22-dirty-little-industry-secrets-from-those-in-the-know/87443372/">company's "dirty little secret."</a> And for them, the only decision was to boycott. </p><p><br></p><p>It's well known that some of the most successful companies in the United States and the world are absolutely awful. Amazon, Walmart, and Nestle just to name a few. Horrible working conditions, child labor rumors, harmful political lobbying, and blatant human rights violations are just some of this group's collective crimes. Unfortunately, many of them are so ubiquitous that they're impossible to avoid. But everyone has a line they just won't cross, and some dirty secrets are just too much for people to stomach. </p><p><br></p><p>For example, Nestle is well-documented for trying to privatize water. As the comedian Bill Burr once said about Nestle's CEO, "That guy should be hunt[ed] down and shot." For more than a few people in this gallery, Nestle was on their list of no-goes. </p><p><br></p><p>Unfortunately, boycotting the big corporations won't do anything more than ease your own conscience. But avoiding small businesses because of personal beef? That just might work. Dan the toyshop owner seemed to be a specific target for one unsatisfied toy owner in this thread. Yeah, "F- you Dan!"</p>](https://cdn.ebaumsworld.com/thumbs/2023/10/10/115407/87457672/stopcompany-fixed.jpg)

0 Comments